Will Verizon’s Purchase of Frontier be Good for Customers?

Verizon says yes, pointing to service quality, mobile phone bundles, and straightforward pricing

Oct 22, 2024 | Share

News

Verizon will make its services available to Frontier customers the same day it closes its proposed transaction with Frontier Communications, the companies told the Federal Communications Commission (FCC) in a joint filing last week.

If the sale is approved by Frontier shareholders and approved by the FCC, here’s a look at what could change.

Verizon and Frontier by the numbers

Frontier

- 3.1 million fiber internet customers

- Annual revenue of $5.8 billion in 2023

- Fiber network in 25 states

Verizon

- 7.4 million fiber internet customers

- Annual revenue of $134 billion in 2023

- Fiber network in 11 states

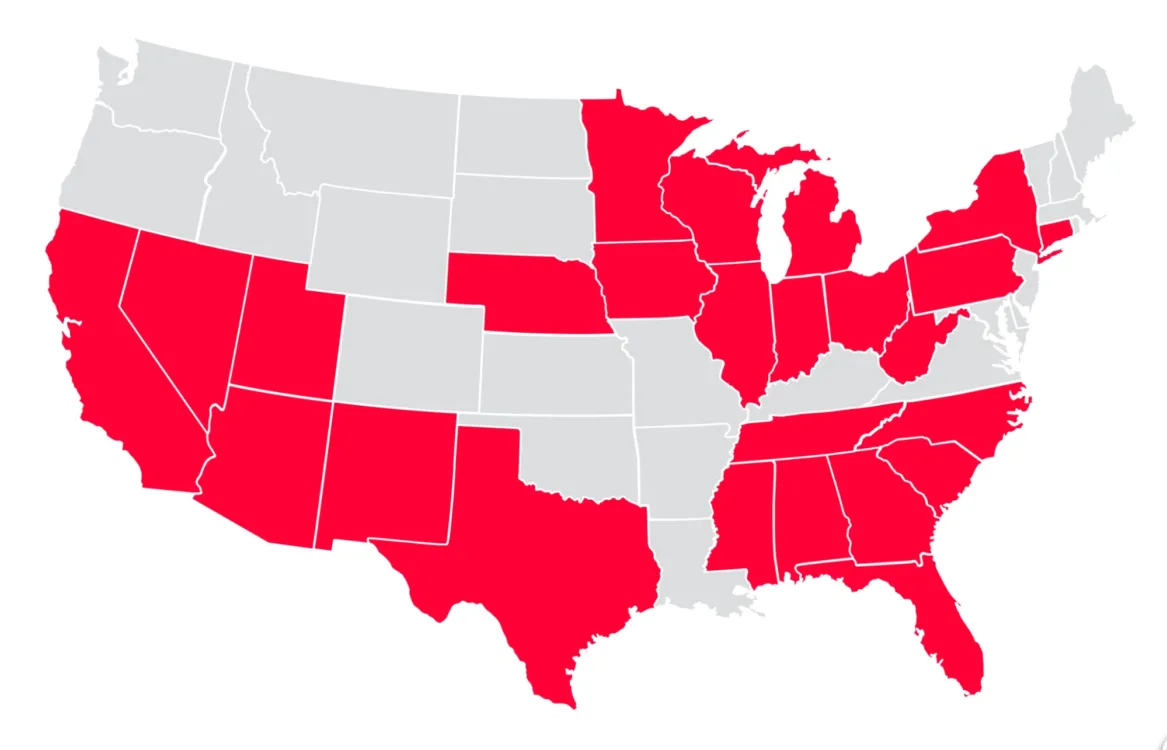

Frontier service area

Frontier has a presence in 25 states: Alabama, Arizona, California, Connecticut, Florida, Georgia, Illinois, Indiana, Iowa, Michigan, Minnesota, Mississippi, Nebraska, Nevada, New Mexico, New York, North Carolina, Ohio, Pennsylvania, South Carolina, Tennessee, Texas, Utah, West Virginia, and Wisconsin (including Virginia customers served by West Virginia infrastructure).

Verizon service area

Verizon offers mobile phone service nationwide but has internet customers in 11 states: Massachusetts, Rhode Island, Connecticut, New York, New Jersey, Pennsylvania, Delaware, Maryland, North Carolina, Virginia, and the District of Columbia.

Verizon offers simpler but more expensive bills

Verizon offers the same prices to new customers as it does to old customers, and it says it will continue this practice with new customers it inherits from Frontier. In other words, Verizon is saying it will end Frontier’s deal that gives fiber customers a $10 monthly discount in their first year of service.

We like the simplicity, but it’s a bummer that Fios pricing is still about $10 more expensive than Frontier’s fiber plans, even after promotions expire.

We don’t know yet if Verizon will offer the 5Gbps and 7Gbps now available from Frontier, since Verizon’s fastest plan for residential services is 2Gbps.

Pricing for Verizon Fios vs. Frontier fiber internet

| Plan | Price | Increase after 12 months |

|---|---|---|

| Frontier Fiber 200 | $29.99/mo.* | $10/mo. |

| Verizon Fios 300 Mbps | $49.99/mo.† | None |

| Frontier Fiber 500 | $44.99/mo.‡ | $10/mo. |

| Verizon Fios 500 Mbps | $74.99/mo.† | None |

| Frontier Fiber 1 Gig | $64.99/mo.§ | $10/mo. |

| Verizon Fios 1 Gig | $89.99/mo.† | None |

| Frontier Fiber 2 Gig | $99.99/mo.# | $10/mo. |

| Verizon Fios 2 Gig | $109.99/mo.† | None |

| Frontier Fiber 5 Gig | $129.99/mo.|| | $10/mo. |

| Frontier Fiber 7 Gig | $299.99/mo.** | $10/mo. |

Data as of 10/21/2024. Offers and availability may vary by location and are subject to change. See disclaimers.

Both companies offer free Wi-Fi equipment and don’t require contracts with their standard plans. However, you could get tied into a year-long contract with Frontier (and an accompanying early termination fee up to $100) if you accept a gift card deal when you sign up.

Frontier offers a better customer experience

We compared Verizon and Frontier head to head in our 2024 internet provider review and scored Frontier a solid 7.9, compared to Verizon’s 7.3. However, Verizon offered faster speeds, with an average download speed of 163Mbps compared to Frontier’s average of 149Mbps.

For the Value category, Frontier topped all competing providers with a score of 8.8 while Verizon made tenth place with a score of 6. However, Verizon beat out Frontier for reliability with a score of 8.7 compared to Frontier’s 7.7. Verizon also won on customer service with a score of 8.3 compared to Frontier’s 7.3.

Frontier’s mix of low rates and fiber speeds set it apart as the nation’s best-value ISP. Image by Kayla Fischer | HighSpeedInternet.com

* Data from HighSpeedInternet.com Speed Test

If the purchase goes through, we may not see a lot of infrastructure changes on the ground, but Verizon has promised to implement its networking tech right away. This would include performance-based reporting for outages and tools that check whether a second path on a network is available before techs perform maintenance.

Customers would also benefit from customer support upgrades, including automatic diagnostic tests based on what they say when they contact support, remote fixes made possible using their own smartphones, and tools that allow field techs to measure Wi-Fi signal within customer’s homes.

Verizon offers discounted plans for low-income customers

Low-income customers will benefit if Verizon is allowed to buy Frontier, the companies told the FCC. With the Verizon Forward plan, eligible customers can get up to $30 off their internet plans per month. They can add a credit of $9.25 per month if they qualify for the Lifeline federal assistance program, resulting in an internet bill as low as $20 per month.

Read more about low-income internet from Verizon and Frontier’s cheapest plans.

Verizon offers deals for bundling with mobile service

Newly minted Verizon customers would also get the chance to bundle their internet and mobile phone services, the filing says. Unlike many of the cable internet companies with which it competes, Frontier doesn’t offer any mobile bundling options to its 3.1 million customers, spread across 25 states.

With Verizon, customers can get either internet or mobile service for as little as $35 per month when they bundle with another Verizon service.

Verizon offers streaming service options with Verizon Home

Frontier doesn’t offer any streaming services, but Verizon lets its Fios customers add the following streaming service subscriptions to their plans for $10 each per month:

- Netflix & Max (with ads)

- Disney Bundle (Hulu, Disney+, and ESPN)

- Apple One

- Walmart+

- Apple Music Family

- YouTube Premium

- +play Monthly Credit

- Unlimited Cloud Storage

- Home Device Support & Protection

In addition to streaming services, Fios customers can add live TV services with either YouTube TV (starting at $62.99 per month) or Fios TV (with prices ranging from $85—$129 per month).

What will happen to DSL customers?

Both Verizon and Frontier have DSL customers, but these connections are being phased out by a combination of 5G/4G LTE home internet and fiber internet.

In their recent filing with the FCC, the companies placed no monetary value on DSL connections.

Looking for fiber internet near you?

Enter your zip code to compare local providers and save.

What happens next with the proposed sale?

While we wait for the FCC to decide on the deal, Frontier shareholders will get a vote on Nov. 13. We don’t know for sure what will happen, but some of Frontier’s biggest institutional investors are throwing a wrench in the works.

Cooper Investors, an Australia-based institutional investor of Frontier, sent an open letter saying Frontier should ask for more money. Glendon Capital Management and Cerberus Capital Management, who together own 17.3% of Frontier, also think the purchase price is too low, even though analysts at BNP Paribas said AT&T and T-Mobile turned down the chance to buy Frontier, according to reporting by Fierce Network.

The objections may mean Verizon offers a higher price ahead of the vote, or it could mean a majority of Frontier investors reject the deal.

If the sale goes through, though, Frontier customers could become Verizon customers within about 16 months. If construction plans continue as scheduled, that could mean 10 million new Fios customers by the end of 2026.

Disclaimers

* Frontier Fiber 200

w/ Auto Pay & Paperless Bill. Max wired speed 200/200 Mbps. Wi-Fi, actual & average speeds vary. One-time charges apply.

† Verizon Fios

Price per month with Auto Pay & without select 5G mobile plans. Consumer data usage is subject to the usage restrictions set forth in Verizon’s terms of service; visit: https://www.verizon.com/support/customer-agreement/ for more information about 5G Home and LTE Home Internet or https://www.verizon.com/about/terms-conditions/verizon-customer-agreement for Fios internet.

‡ Frontier Fiber 500

w/ Auto Pay & Paperless Bill. Max wired speed 500/500 Mbps. Wi-Fi, actual & average speeds vary. One-time charges apply.

§ Frontier Fiber 1 Gig

w/ Auto Pay & Paperless Bill. Max wired speed 1000/1000 Mbps. Location dependent. Wi-Fi, actual & average speeds vary. One-time charges apply.

# Frontier Fiber 2 Gig

w/ Auto Pay & Paperless Bill. Max wired speed 2000/2000 Mbps. Wi-Fi, actual & average speeds vary. One-time charges apply.

||Frontier Fiber 5 Gig

w/ Auto Pay & Paperless Bill. Max wired speed 5000/5000. Wi-Fi, actual & average speeds vary. One-time charges apply.

** Frontier Fiber 7 Gig

w/ Auto Pay & Paperless Bill. Max wired speed 7000/7000. Wi-Fi, actual & average speeds vary. One-time charges apply.

Author - Chili Palmer

Chili Palmer covers home tech services, with a special focus on understanding what families need and how they can stay connected on a budget. She handles internet access and affordability, breaking news, mobile services, and consumer trends. Chili’s work as a writer, reporter, and editor has appeared in publications including Telecompetitor, Utah Business, Idaho Business Review, Benton Institute for Broadband & Society, and Switchful.com.

Editor - Jessica Brooksby

Jessica loves bringing her passion for the written word and her love of tech into one space at HighSpeedInternet.com. She works with the team’s writers to revise strong, user-focused content so every reader can find the tech that works for them. Jessica has a bachelor’s degree in English from Utah Valley University and seven years of creative and editorial experience. Outside of work, she spends her time gaming, reading, painting, and buying an excessive amount of Legend of Zelda merchandise.